This article was first published in Hotel Executive on November 10th 2019.

Developing destinations for tomorrow is not for the faint-hearted, folks. It requires vision, government support, forward-looking market analysis, investment and experts in delivery. It is also complex, lengthy and costly; and the stakeholders are demanding.

Tourists are travelling overseas more than ever before (international travellers spent US$1.7 trillion overseas in 2018, up 4% on prior year, according to the UNWTO) and always looking for new places to visit, eat, stay, entertain and enjoy; we are also are hungry for experience. And governments are looking for ways to sustain their economies and workforce. It has the potential for win-win.

Twenty years ago, I was standing, knee deep in the pristine waters of Navarino Bay in Greece, talking through the vision for Costa Navarino. The resort project was to be built on a 1,000 hectare site (circa 2,500 acres) that had been stitched together over a generation, through a series of land acquisitions by the owner – a Greek shipping magnate who had grown up in the area. Legacy building was central to the project. The masterplan balanced topography with the culture, history and natural assets of the area.

The project involved the careful movement and replanting of ancient olive groves, incorporation of historic buildings into the long-term vision; and environmental planning. Today, Costa Navarino publishes an annual sustainability report. The resort has two luxury hotels, two golf courses, a spa and residences. Building the destination has been hard fought, working through domestic and regional economic crises, refinancing and new competition.

The author, 20 years ago, standing knee-deep in the pristine waters of Navarino Bay, Greece

However, an unwavering vision was critical to Costa Navarino’s success. Almost a decade after completing phase one, phase three development is underway: private residences for sale, to generate on-resort animation and demand, to drive investment returns and to extend the season.

Residential has long been a critical success factor in resort and destination development. Branded residences and serviced apartments mitigate development risk by providing upfront cashflow. Irene Hoek, Vice President Global Residential Development for Rosewood Hotels & Resorts, notes “Residences also drive additional value to owners and developers by anchoring a destination, reducing seasonality, and establishing ownership of destination, by people who either live there permanently or return year after year.” Half of Rosewood’s hospitality portfolio comprises residential operations.

The upsurge in popularity in the Mediterranean and Adriatic is driving a new wave of hotel investment, particularly in renovations. And whilst it may be financially beneficial in the short-term to flatten old buildings with historical significance, interest and soul, and build eminently forgettable and entirely replicable real estate, this is counter-productive for successful destination building. The appeal of regeneration is that you can often build on a rich history, great stories, prime locations/vistas and iconic architecture.

This summer, Four Seasons re-opened the iconic Astir Palace Athens – a resort with multiple modernist-designed buildings on a 30 hectare (74 acres) coastal peninsula, half an hour from central Athens. It has been the playground of wealthy Athenians, international stars and magnates since the 1960s so the story-telling potential is great; and the €650m renovation was designed to put it right back on the map.

Fundamental to the success of any destination is robust carrying capacity analysis (i.e. how many people/vehicles can the site reasonably handle at any one time), in order to optimise the visitor experience and manage the environmental impact. This is easier to manage with standalone assets than locations, where control is not held by any one stakeholder.

There are an increasing number of destinations suffering from that 21st century blight of over-tourism, including: Amsterdam; Barcelona; Boracay in The Philippines; Maya Bay in Thailand; Mount Everest; Venice. Dr Rachel Dodds, Professor, Ryerson University, Director and Owner of Sustaining Tourism and co-editor of Overtourism, observes that “once a destination is destroyed in any way – be it environmental damage or local animosity – the worst of the damage is done. Proactive planning and management need to be implemented to avoid issues of overtourism and unsustainable development.” It seems that many countries need a more joined-up approach across the travel and tourism supply chain, in order to manage tourism volumes better.

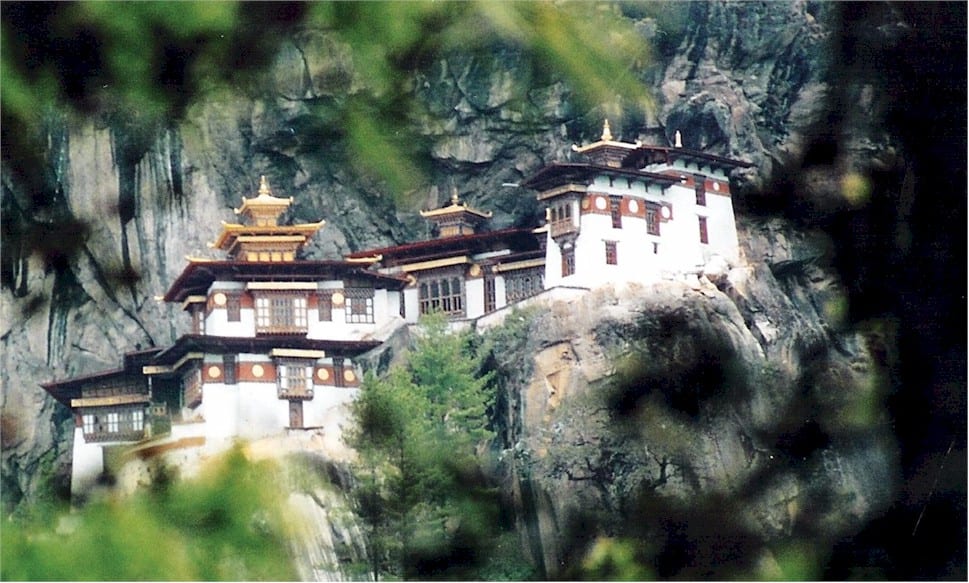

Government support is fundamental to developing, nurturing and protecting destinations. The Kingdom of Bhutan, is often cited as adopting a visionary tourism policy. Lonely Planet describes it as “no ordinary place … where a traditional Buddhist culture carefully embraces global developments.” Indeed it does; and this “careful” approach to tourism is tightly controlled centrally – something that many national tourism industries are not subject to (and may also not wish for).

In 2018, Bhutan recorded close to 280,000 tourist arrivals. Whilst Bhutan does not cap the number of tourists, the government is actively building an exclusive, high-yield industry, with a tourism policy built on the principle of sustainability. “Tourism must be environmentally and ecologically friendly, socially and culturally acceptable and economically viable”.

Bhutan: “Tourism must be environmentally and ecologically friendly, socially and culturally acceptable and economically viable”.

Costs include a minimum daily package spend per tourist of US$200-250, which also includes a Sustainable Development Fee towards free education, free healthcare and poverty alleviation within the Kingdom. Hotel development is very controlled, with a handful of international hotel brands currently operating in the Kingdom, most in the luxury category, including: Amanresorts, Como, Le Meridien, Six Senses and Taj. Bhutan is meeting the growing demand from affluent visitors for places that are out of the ordinary.

This demand for extraordinary experiences is an inevitable consequence of being materially wealthy, according to 1970s futurists Alvin and Heidi Toffler (authors of The Future Shock). The Experience Economy theory, as defined by Pine & Gilmore (1999), also hypothesises that as soon as a specific level of prosperity is reached, interest and demand shift from products and services to experiences.

Richard Arnold, Chief Development Officer at Auberge Resorts Collection notes that the increasingly global world we live in today also has a part to play in this trend. “The modern luxury traveller in particular is not looking for an experience they can have at home.” So, we are seeing a return to products and encounters that are local, rich in character and hard to replicate. That’s what lies at the core of the experiences Auberge Resorts Collection is creating for its guests. Arnold again: “Luxury guest expectations have evolved beyond physical product alone – people are now seeking experiences that touch the heart and rejuvenate the soul.”

Duty & Quality Manager at the Conservatorium Hotel Amsterdam, Michelle Bullens, observes “We often do not remember an exact experience, but we always remember how we felt during that experience.” Destinations need to elicit strong feelings from consumers, to create memories.

So that’s all fine but ultimately a destination is the product of a mix of real estate, attractions, design and services. Creating the right product mix for the future is a real challenge. HoCoSo works a lot with consumer insight professionals and owners to create new hospitality products and what we think is essential today, will not be tomorrow. Think car parking, car charging, phone charging and permanent offices, for example.

These trends might have a positive impact on the investment requirement, particularly in greenfield/remote developments, where infrastructure investment is essential and onerous (utilities, roads and landscaping). If governments are seeking to position destinations higher on the value curve, or improve the environmental provision within the project, then fiscal support is often essential to secure the right long-term investor to the project. Historically, it has typically been the third or fourth owner/investor that makes a return.

The next generation of large-scale masterplanned resorts, anchored in social, environment and financial sustainability are already in development. Some will be pioneers and others will fall short, but better to have tried and failed than not to have tried at all, surely?

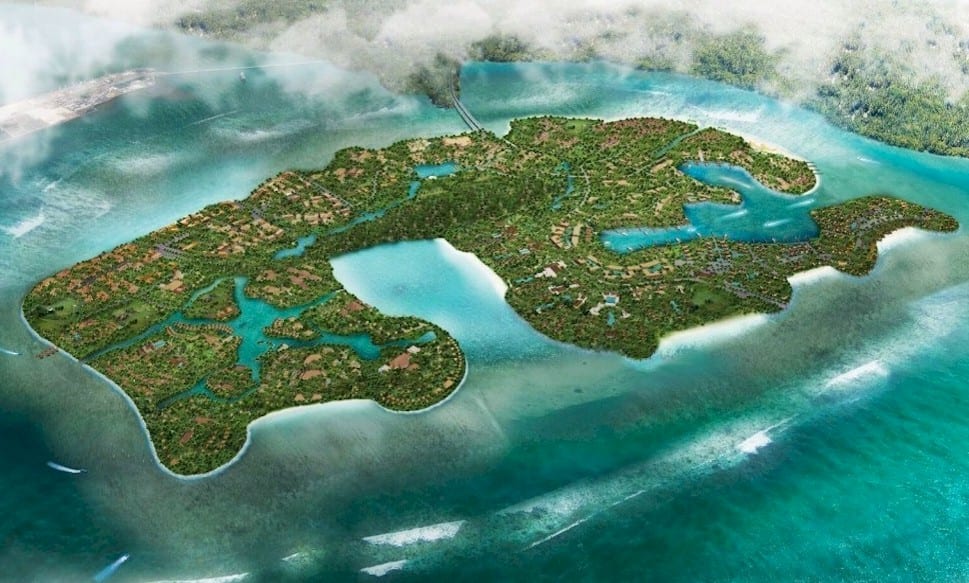

Kura Bali, a 500-hectare project off the south-east coast of Bali, Indonesia

Pushing the envelope is Kura Bali, a 500-hectare project off the south-east coast of Bali, Indonesia. Dubbed the Island of Happiness, the project is anchored on an indigenous philosophy of ecological, social and spiritual harmony and the United Nations Sustainable Development Goals (SDGs). It is backed by a diverse group of stakeholders, including successful Singaporean conglomerate Tuan Sing, who will all need to buy into the project vision and goals.

We are beginning to get the message. Not only is ESG-led investment (Environment, Social, Governance) an increasingly popular investment philosophy, but the establishment is beginning to engage. In August, Business Roundtable – an association of CEOs of America’s leading companies – announced a new Statement on the Purpose of a Corporation, signed by 181 CEOs. Most significant is the move away from saying that a corporation’s sole purpose is to create shareholder value. Rather, the remit has been broadened to a commitment to lead companies for the benefit of all stakeholders – customers, employees, suppliers, communities and shareholders.

If shareholders get it too, we shall see change for good. Even the Royals are on it; in September 2019, Prince Harry, Duke of Sussex, launched Travalyst – a new partnership bringing travel companies together to find solutions to make travel more ethical and sustainable; founding partners include booking.com, ctrip, skyscanner, tripadvisor and Visa.

So, the idealist in me cheers the rise of social and environmental responsibility. We really might avoid killing the goose that lays the golden egg, after all.

Navarino Bay, Greece today

Ms. Le Quesne

Katharine Le Quesne has spent two decades as a professional advisor to the travel, hospitality and leisure industries. She works all over the world in emerging and mature markets, helping clients to assess opportunities for value creation. She loves what she does and has a particular specialism in: development strategy; destination resorts; luxury and lifestyle brands; and theme parks. Ms. Le Quesne began her career with Jones Lang LaSalle in China, during China’s first real estate boom. She subsequently worked for global professional services firms Arthur Andersen and Deloitte in Europe and Asia, prior to joining HoCoSo. She is a regular speaker at industry events, a writer on industry issues and has been a professional advisor on the World Economic Forum Travel & Tourism Competitiveness Report. She is also a Visiting Lecturer at a number of world-class hotel schools. Ms. Le Quesne speaks English, Mandarin Chinese and French. Katharine Le Quesne can be contacted at 7979 703444 or katharine@hocoso.com Please visit http://www.hocoso.com for more information.

About HoCoSo

HoCoSo are advisors with a difference. We create tailor-made and innovative solutions for clients’ hospitality-led projects by bringing together the optimum team of sector specialists. Jonathan Humphries, Chairman and Owner of HoCoSo, and his direct team specialize in the extended-stay, co-living, and hotel-alternatives hospitality market; luxury, lifestyle and boutique hotels; and resort developments in Europe, the Middle East and Africa (EMEA). Our strengths lie in the following core services:

- Product & Concept Creation, for portfolio & individual asset developments

- Strategic Development Projects with a focus on new-market / new-concept business expansion planning, operator selection, market and financial feasibility studies

- Transformative Asset Management for brand re-positioning, asset re-evaluation and concept re-structuring.

- Hospitality Education for companies and academic institutions, with a focus on bespoke course development, training and teaching

- Workshops, Keynotes and Conference Moderating for boards, leading international conferences and incubators

Leave A Comment